Civil Monetary Penalty Proposed Regulations Are Here

By GRSM MedicareTeam on February 14, 2020

Leave a comment

The Medicare Secondary Payer law rendering a potential $1,000 per day penalty for noncompliance against primary payers has finally been demystified to some extent. The proposed regulation issuing guidance about Medicare Secondary Payer Civil Monetary Penalties relative to Section 111 reporting was unofficially disseminated on February 13, 2020, and the full text can be found here. The official document is scheduled to be published in the Federal Register on 2/18/2020 and available online at https://federalregister.gov/d/2020-03069.

By way of history, this rule has been in progress since 2013, pursuant to the Strengthening Medicare and Repaying Taxpayers Act (SMART Act) of 2012, which amended the Medicare, Medicaid and SCHIP Extension Act of 2007. The 2007 law rocked the industry by calling for mandatory penalties against NGHP primary payers of $1,000 per day per claimant for failure to properly report Section 111 data to Medicare. The SMART Act softened this, making the penalty discretionary rather than mandatory. The details of what would constitute a full penalty, diminished penalty and/or safe harbor from Civil Monetary Penalties have not been promulgated by the Agency until now. As of this date, no penalties have been assessed against NGHP primary payers. Having a rule in place could change this.

With 44 pages in all, there is a great deal of content within the proposed rule, the highlights of which are summarized below. As always, the Gordon & Rees Medicare Compliance Group will issue an Official Comment to this proposed rule. We will accept client feedback regarding this rule, through April 15, 2020, as Official Comments which must be received no later than 60 days from the date of official publication.

If more information is needed and/or you have questions about how this may impact your business please contact us at Section111 Reporting Section111Reporting@grsm.com.

Highlights:

• The regulation outlines proposed specific criteria for when CMPs would not be imposed, in circumstances when a NGHP entity fails to comply (either on its own or through a reporting agent) with Section 111 reporting guidelines.

• CMPs will be levied in addition to any MSP conditional payment reimbursement obligations.

• The rule is prospective and CMS will evaluate compliance based only upon files submitted by the RRE on or after the effective date of the final rule.

• There will be a formal appeal process for RREs if they disagree with the CMPs assessed against them.

CMS generally identified three categories of CMPs:

- Failure to report

- Submitting responses to recovery efforts contradicting reporting

- Submitting records with errors that exceed CMS’s error tolerance threshold

Statute of Limitations: - CMS may only impose a CMP within 5 years from the date when the non-compliance was identified by CMS. The regulation outlines specifically how this will be calculated for each of the three proposed types of CMPs.

• If an RRE fails to report within the required timeframe (no more than 1 year from the TPOC date), the penalty would be calculated on a daily basis, based on the actual number of individual beneficiaries’ records that the entity submitted untimely.

TPOC Reporting: - Penalty would be up to $1,000 (as adjusted annually for inflation based on 42 CFR part 102) for each calendar day of noncompliance for each individual, as counted from the day after the last day of the RRE’s assigned reporting window where the information should have been submitted, through the day that CMS received the information, up to a maximum penalty of $365K per individual per year.

ORM Reporting: - If an RRE fails to report an ORM termination date, the penalty would be calculated based on the number of calendar days that the entity failed to report updates to the record. The penalty would be up to $1,000 (as adjusted annually for inflation) per calendar day of noncompliance for each individual, for a max annual penalty of $365K per year.

- Please note, while most of the penalties listed are prospective, the ORM termination reporting is retroactive if not terminated properly.

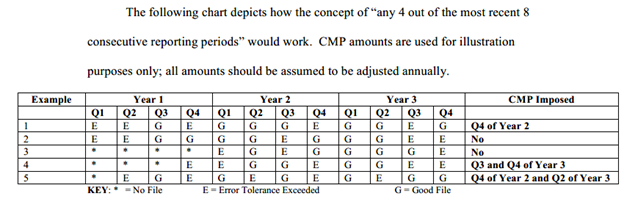

CMPs Will be Imposed for the Following Errors: - If the RRE exceeds any error tolerance(s) threshold in any 4 out of 8 consecutive reporting periods.

- The initial and maximum error tolerance threshold would be 20% (representing errors that prevent 20% or more of the beneficiary records from being processed).

- CMS intends for this tolerance to be applied as an absolute percentage of the records submitted in a given reporting cycle.

- CMS will maintain current notification process where RREs receive notice via response file and direct outreach (email and, in more serious cases, telephone calls) when there are errors with their file submissions.

- An RRE is out of compliance for the entire reporting period when the RRE exceeds the error tolerance threshold. (90 calendar days equals one reporting quarter)

- CMS is proposing a maximum 20 percent per file submission error tolerance. The errors that would be used to determine whether the error tolerance is met shall be defined by CMS 6 months prior to imposition of any CMPs.

- CMPs would be imposed on a tiered approach if the RRE exceeded the error tolerance(s) in the entity’s fourth above-tolerance submission. Penalties and calculation percentages are outlined in detail within the regulation; however, we have included the chart below directly from the regulation that summarizes the tiered penalty approach CMS is proposing. For a more detailed discussion of this, please reference the proposed regulation itself.

• No CMP will be imposed in the following circumstances where all applicable conditions are met:

- If you report a claim timely; and

- Comply with TPOC reporting thresholds and any other reporting exclusions; and

- Don’t exceed any error tolerances in any 4 out of 8 consecutive reporting periods; and

- If the RRE fails to report required information because they were unable to obtain the necessary information from the beneficiary following a good faith effort to obtain this information which is defined in the regulation as communicating the need for the information twice by mail and at least once by phone or electronic communication. The RRE should maintain these records for a period of 5 years.

Disclaimer: Please note, this article is intended to be a high-level summary of the proposed regulation and is not intended to be an exhaustive review of every detail and requirement contained within the text of the proposed regulation. We will be providing a Webinar Series to discuss the fine details, business implications and best practices surrounding Section 111 Mandatory Insurer Reporting for NGHPs.

Let us know if you want to schedule a meeting to discuss in detail how this rule impacts your business.